NNPC News, Updates and Analysis

When talking about NNPC, the National Nigerian Petroleum Corporation, Nigeria’s state‑owned oil giant that handles exploration, production and marketing of hydrocarbons. Also known as Nigeria National Petroleum Corporation, it sits at the heart of the country’s energy policy and revenue stream. Nigeria, the most populous nation in Africa with a diversified but oil‑dependent economy relies heavily on NNPC’s cash flow to fund infrastructure, health and education. Oil sector, the backbone of Nigeria’s export earnings and a major employer therefore mirrors the corporation’s performance. In short, NNPC isn’t just a company; it’s a national engine that powers budget decisions and everyday life.

Why NNPC matters for the economy and the everyday citizen

Energy policy, the set of rules and strategies governing fuel production, pricing and sustainability directly shapes NNPC’s operations. Recent debates on fuel subsidies, for example, illustrate how government choices affect pump prices and household budgets. When subsidies are high, the treasury spends heavily on cheap fuel, which can strain public finances and crowd out investment in roads or schools. Conversely, cutting subsidies can boost NNPC’s profitability, but may spark public protests if fuel becomes too pricey. This tug‑of‑war forms a core semantic triple: NNPC requires clear energy policy to balance revenue generation and social stability.

Governance is another key piece. The corporation’s board often faces pressure from political leaders who want to steer contracts toward allies. Transparency lapses can lead to audits, legal disputes, and loss of investor confidence. A third semantic link emerges: strong government oversight influences NNPC’s ability to attract foreign partnerships, which in turn impacts the oil sector’s growth. Recent court cases involving funding transfers highlight how fragile the financial flows can be, reinforcing the need for robust oversight mechanisms.

Market dynamics add a fourth layer. Global oil prices, OPEC production quotas and regional competition all affect NNPC’s revenue streams. When Brent climbs above $80 a barrel, NNPC’s cash reserves swell, enabling new drilling projects and debt repayments. When prices plunge, the corporation leans more on government support, often sparking calls for reforms. This creates the semantic triple: global oil price trends dictate NNPC’s fiscal health, which then shapes national budget planning.

All these elements—energy policy, governance, market forces—interlock to form a complex picture. Below, you’ll find a curated mix of stories that touch on NNPC’s recent deals, policy debates, regional oil news and the broader economic impact. Whether you’re tracking subsidy reforms, watching the latest production numbers, or just want to understand how the nation’s oil engine runs, the collection offers practical insight without the jargon.

So dive in and explore the range of articles that unpack NNPC’s role in Nigeria’s growth, its challenges, and the opportunities ahead.

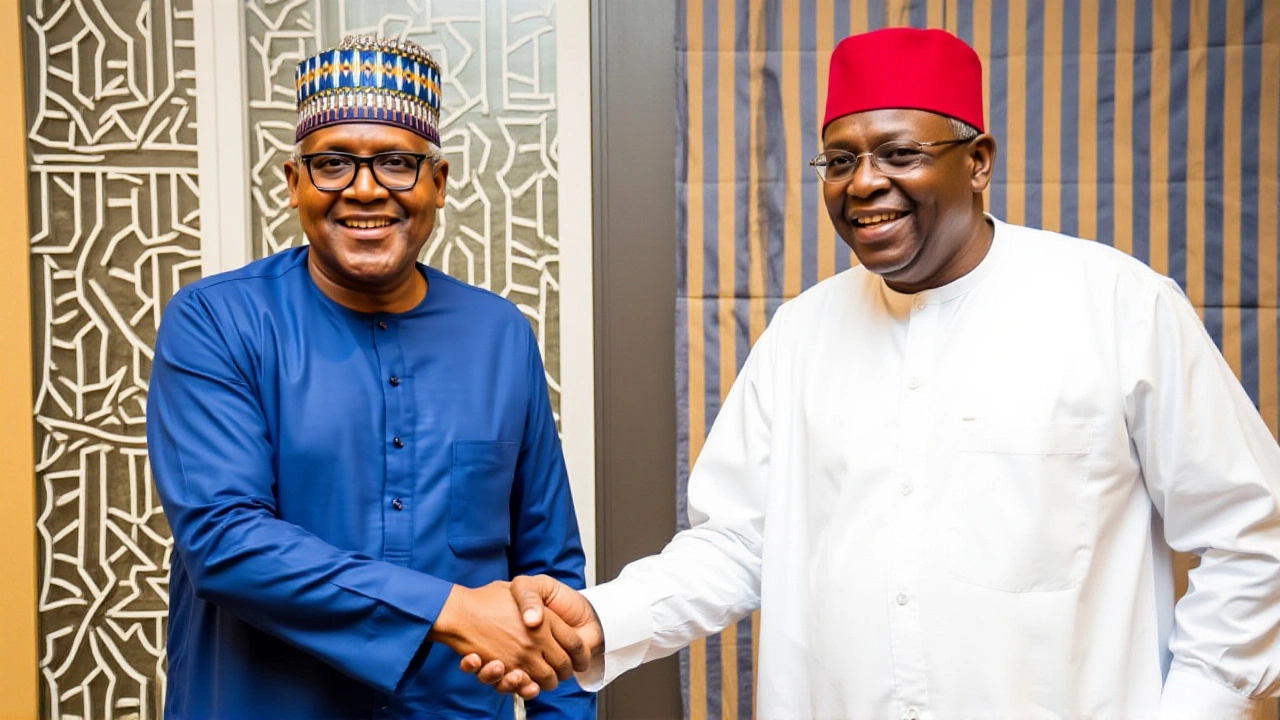

Dangote Praises Tinubu’s Oil Reforms, Cites New NNPC Leadership

By Sfiso Masuku On 7 Oct, 2025 Comments (16)

Aliko Dangote lauds President Tinubu’s oil‑sector reforms, backs new NNPC leadership, and thanks the president for averting a PENGASSAN strike, highlighting rising rigs and production targets.

View More