Debt repayment: simple, practical steps to get out of debt

Feeling trapped by loans or credit cards? You're not alone. Debt can pile up quietly until it feels overwhelming. The good news: with a clear plan and small daily habits, you can reduce what you owe and regain control. This guide gives direct, useful steps you can start using today.

Pick a repayment method that works

Two popular ways actually work—choose one that fits your mood and money situation. The avalanche method targets the highest interest first. That saves money over time. Example: if Card A is 20% and Card B is 10%, throw extra payments at Card A until it's gone.

The snowball method goes by balance: pay off the smallest debt first to build momentum. It won’t always save the most interest, but the quick wins keep you motivated. Try the avalanche if you hate giving away interest; try the snowball if you need wins to stay on track.

Practical moves you can make this month

1) List every debt: lender, balance, interest, and minimum payment. Seeing numbers reduces anxiety and lets you plan. 2) Cut one recurring cost this month and add that amount to debt payments. Even $10–$20 extra helps. 3) Automate at least the minimum payments so you never miss one—late fees only make debts worse.

Consider consolidation if you have many high-interest debts. A personal loan with a lower rate or a balance-transfer card can reduce interest and simplify payments. Check fees and eligibility first. In some African markets, microfinance or bank consolidation offers may be available—compare rates, terms, and the small print.

If payments are already unmanageable, call your lender. Ask for reduced payments, longer terms, or a temporary hardship program. Lenders would rather get something than nothing. Be honest, explain your income and propose a realistic amount you can pay.

Use local tools where possible. Mobile money apps and bank alerts help track payments and avoid missed due dates. If you rely on informal credit (tontines or stokvels), discuss changes openly with the group—many members prefer a modified plan to defaults.

Build a tiny emergency fund: aim for $100–$300 or the local equivalent. That keeps small shocks from forcing you back into high-interest credit. Once debt drops, grow that fund to cover one month of core expenses.

Finally, protect progress. Don’t open new credit lines while paying down debt. Track your balances monthly and celebrate when a debt disappears—noticeable wins keep motivation high. If you need extra help, seek free debt counselling from trusted NGOs or consumer protection agencies in your country.

Want stories and tips from across Africa on finance and policy? Check Ginger Apple News for updates and guides that fit local realities.

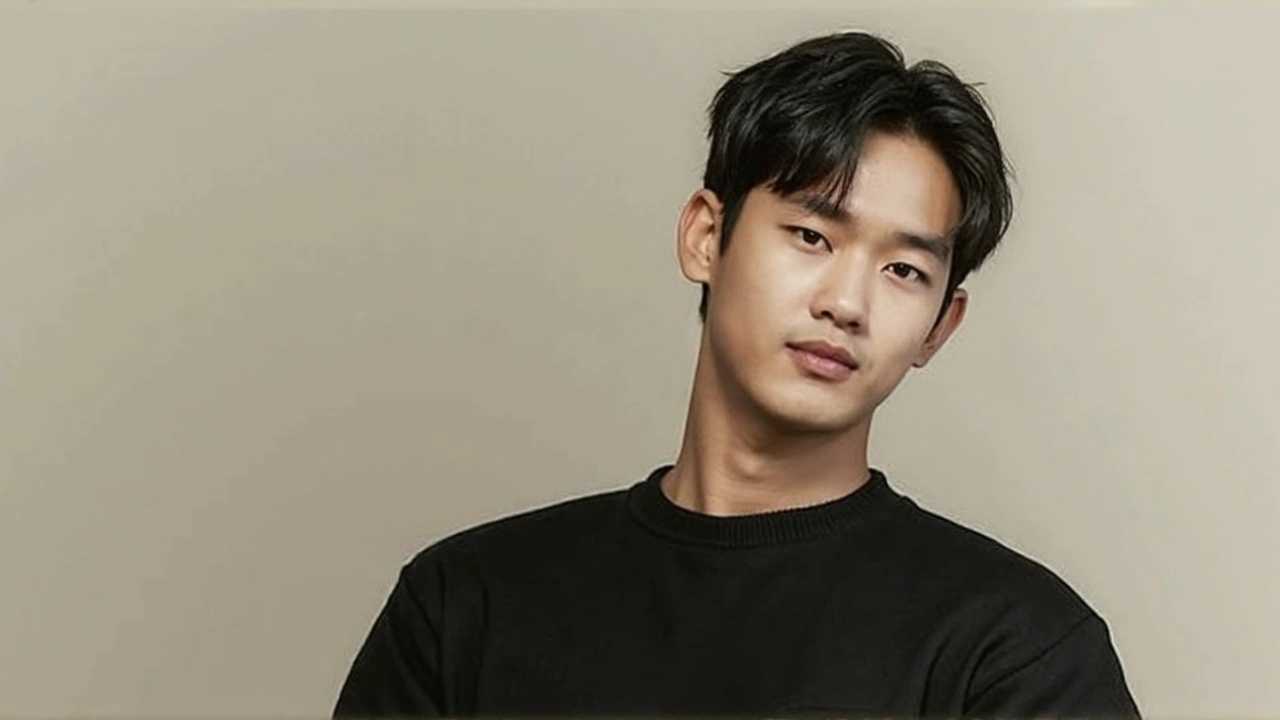

Kim Sae Ron's Heartbreaking Texts Reveal Plea to Kim Soo Hyun Over $500,000 Debt

By Sfiso Masuku On 13 Mar, 2025 Comments (17)

Messages leaked from the late actress Kim Sae Ron show her pleading with actor Kim Soo Hyun for more time to repay a debt nearly reaching $500,000, stemming from legal fees his agency paid on her behalf. Despite initial leniency, Gold Medalist sued her for the full amount, while rumors suggest Won Bin contemplated paying off the debt.

View More